About iBaskets

Investment Basket is an easy way to invest in stocks.

Choose from a range of Investment Baskets to fulfill your financial goals.

At investmentz.com, we offer a set of baskets to meet your investment needs. Each basket is customized to provide assured equity & debt exposure through a portfolio of stocks, Mutual Fund, ETF, and other asset classes.

These baskets are monitored by our team consisting equity & debt specialists, who can help you to make disciplined investments aligned to your financial goals. The baskets are constructed to suit different types of investor risk profiles.

What are ACEs?

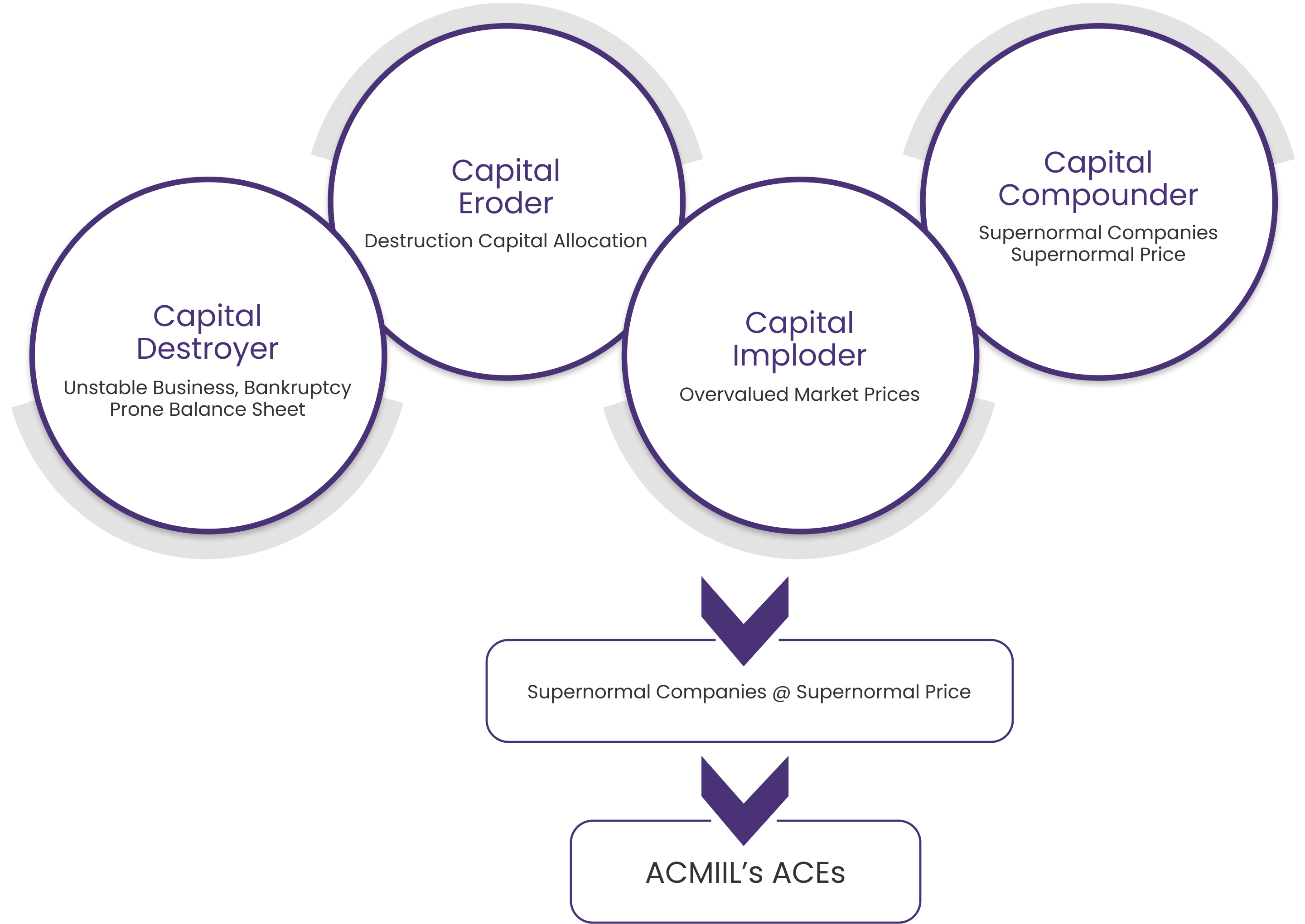

ACE is the supernormal stock basket designed by the ACMIIL market experts through a scientific investing framework. ACEs are developed to match different types of investors with different risk appetites.

Why do I need ACEs?

Many investors, especially beginners, invest in the equity market based on poor research, stock tips- which are unethical elements of investing. The net result can be unpredictable, providing optimum returns.

Safety

ACEs include stocks through the scientific investing framework process. The safety element thus becomes high. Ibasket, just like any other equity investment, is subjected to market risk.

Liquidity

In ACEs, liquidity is high because often traded stocks are included in the basket. Equities in the basket available are for the long-term duration, i.e., a minimum of three years.

Rebalancing Basket

The ACE Baskets are regularly monitored and reviewed. This includes review of the economic and business fundamentals of the existing stocks in the baskets to be consistent with the Scientific Investing Framework. Further, one of the most important aspects of the Scientific Investing Framework is that the stocks should be available at a discount to their intrinsic values. Both these aspects are monitored. From time to time some older baskets will have stocks which are no longer available at a significant discount to intrinsic value, or in rare cases, their fundamentals might have deteriorated. In both cases, these stocks will be sold off from the baskets and the cash generated will be redistributed across the currently recommended baskets. The current baskets have the stocks which have been identified by the Scientific Investing Framework based on a review of the whole investment universe.

This discipline of rebalancing keeps the full investments across the baskets in a fundamentally strong set of stocks, which are available at a discount to their intrinsic values and also keeps it more diversified over a period of time. This reduces risks and increases the chances of higher returns and generation of alpha.

Stock Selection Methodology

Scientific Investing